Venture Capital

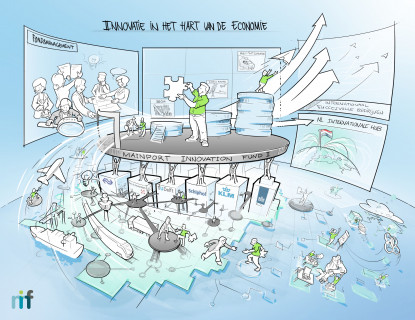

MIF II was founded in 2015 by Schiphol, KLM, TU Delft, NS and Port of Amsterdam, together with NBI Investors, the manager of the fund. We help entrepreneurs accelerate by combining VC funding with the expertise and global network of our partners, who can also act as pilot partner or launching customer.

MIF II invests in innovative technology companies that are gaining traction and are looking for funding, expertise and network to speed up their growth. MIF II aims to acquire a substantial minority interest in its portfolio companies. Initial ticket sizes range from EUR 200.000 to EUR 1.000.000. MIF II is in the position to lead or participate in follow on rounds, up to total commitments of EUR 3.000.000 and over.

What is the goal of the project?

MIF II is the successor of Mainport Innovation Fund I, which was founded in 2009 by Schiphol, KLM, TU Delft and Rabobank and has made ten investments since. MIF I closed on September 30, 2015. MIF II focuses on innovation in Logistics, Transport and Innovation. This includes but is not limited to the following themes: Sustainable infrastructure and materials, connectivity, mobility, intermodal transport, energy, digitization, internet of things, security & safety, seamless travel and big data. We invest both in the B2B and B2C space.

Who initiated the project and which organizations are involved?

MIF II is the successor of Mainport Innovation Fund I, which was founded in 2009 by Schiphol, KLM, TU Delft and Rabobank and has made nine investments since.